After investing in their Series B, Lilly licenses a batch of metabolic candidates – Endpoints News

Eli Lilly to license Regor Therapeutics therapies for metabolic disorders in agreement announcement This will give the Chinese biotech an upfront payment of up to $ 50 million on Friday, part of which is a capital investment.

In a loosely worded statement, Lilly said she had a license for certain “intellectual property” of Regor and would have the option of extending that license. In return, Lilly will oversee the global clinical development and commercialization of all therapies except China, Macau, Hong Kong and Taiwan. Regor, a Shanghai-based company, will reserve the rights to these areas.

The company is eligible for potential payments of up to $ 1.5 billion based on preclinical, clinical and commercial milestones, as well as tiered royalties on sales.

Regor’s CEO Xiayang Qiu said the collaboration is, in part, a recognition of Regor’s core technology, the Computer Accelerated Rational Discovery platform. CARD, another in a long line of fancy-named biotech computing platforms, is designed to create a more efficient process for new drug discovery.

Through CARD, the team has advanced a number of products in their pipeline in just two years, including RGT-587 for oncology, which is about to enter Phase I trials, and and RGT-075 to target a glucagon-like peptide-1 receptor hormone, which stimulates glucose-induced insulin secretion. This candidate is entering Phase II / III trials.

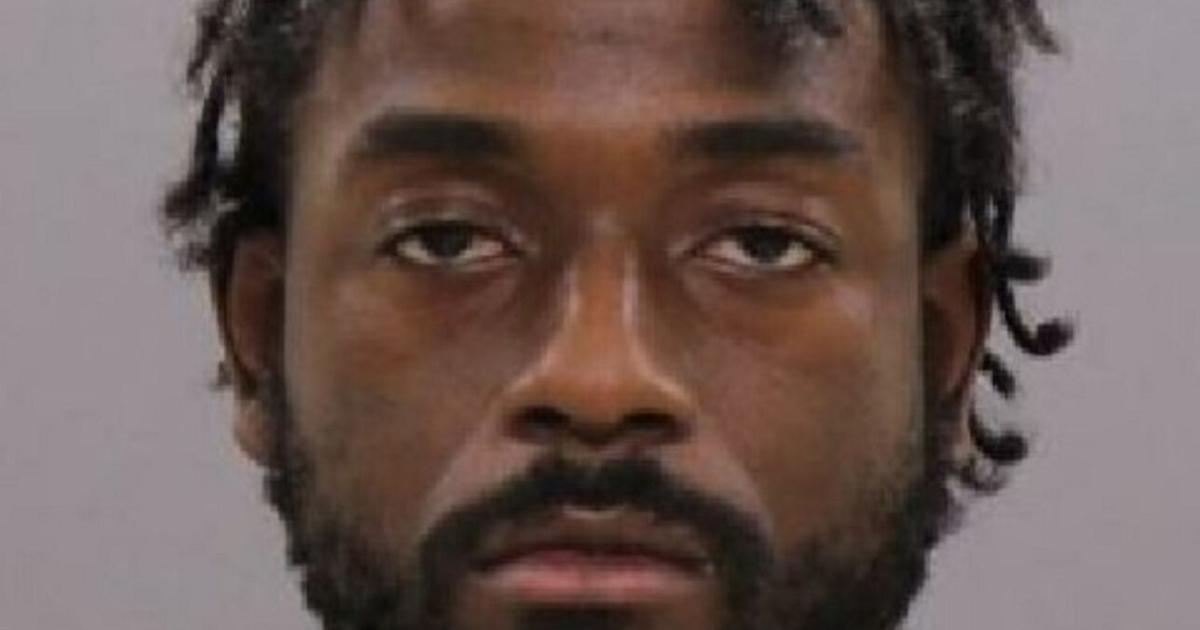

Wenge Zhong

Wenge Zhong

The company was founded in 2018 by a team that included two Pfizer veterans and three – Qiu and Min Zhong, and CTO Wenge Zhong – who worked for Amgen’s Chinese R&D operations. Until now, Regor has focused on oncology, metabolic diseases and autoimmune diseases.

“Regor’s technology will also allow Lilly to further accelerate innovation and deliver breakthrough therapies for obesity and diabetes,” said Ruth Gimeno, vice president of diabetes research at Lilly, in a statement. communicated.

Ruth gimeno

Ruth gimeno

In February, Lilly Asia Ventures led the Series B fundraiser, in which the company raised $ 90 million to support its clinical development. He also landed an investment from Loyal Valley Capital, a company that was instrumental in funding the social media video app TikTok, and was among the top 10 most influential private equity firms in China.

“Together, we are working hard for a better world through innovative and transformative medicines that have a significant impact on patients around the world,” said Andy Lin, founder of Loyal Valley, in a statement. declaration at the time.