Start of classes at the new workforce training center

Council approves police training center | News

Genuine Windows 10 Lifetime License $ 14, Office $ 25, Super 91% Off! – Phandroid

Advocates Again Call for Legislation Capping Payday Loan Rates

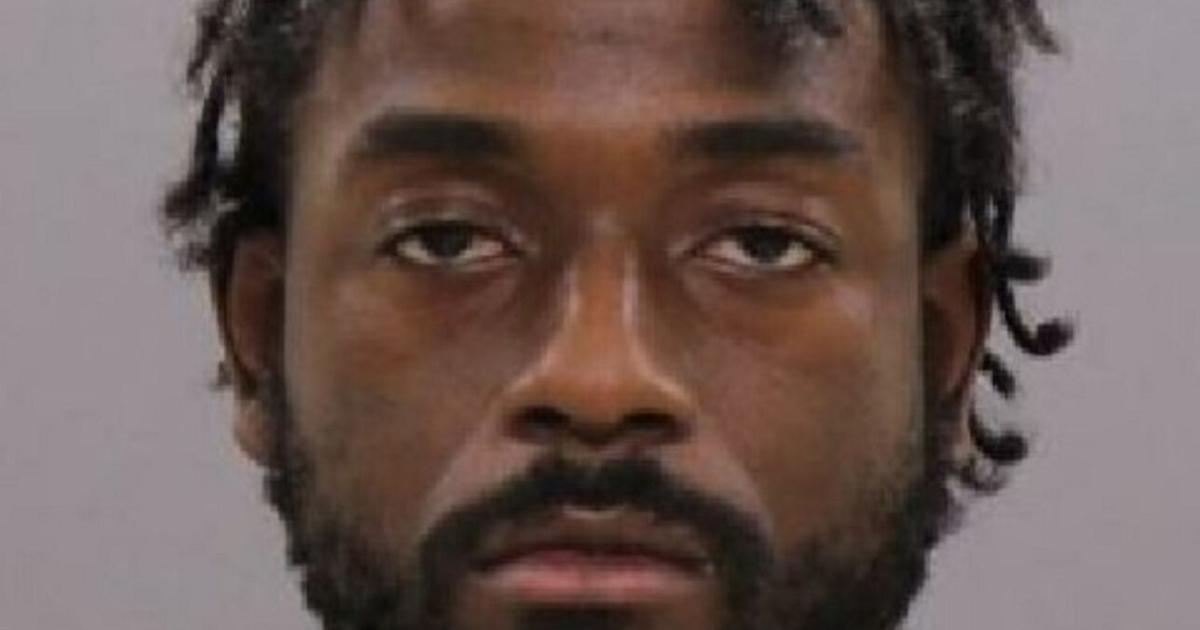

Rochester man with 17 license suspensions charged with crack cocaine | Police

Importance of the Citizen’s Charter and respect for the automation of permit / license systems

Which option suits you best?